oregon workers benefit fund tax rate

25 it would be effective July 1. According to research from Policy Matters Ohio and the.

Contact the UI Tax Division.

. 2021 UI Tax Relief fact sheet. The second form is that should the fund reach a 90 funding level PERS would stop diverting the money until of course the fund dives below 90. The FFCRA as amended by the COVID-related Tax Relief Act of 2020 provides tax credits for self-employed individuals carrying on any trade or business within the meaning of section 1402 of the Internal Revenue Code if the self-employed individual would be entitled to receive paid leave under the FFCRA if the individual were an employee of an employer other than him or herself.

B A labor contractor licensed under ORS 658410 may not claim a credit under this. NE Salem Oregon 97301. These coronavirus stimulus checks from Oregon however would go only to low-income workers.

653026 Nonurban county defined for ORS 653025. General Oregon payroll tax rate information. On Tuesday House Democrats in Oregon reintroduced a bill to give a one-time payment of 600.

The company has grown from 526 Million in 2006 to over 41 Billion in 2014. The reduction would follow a 10 rate reduction for public employers counties cities schools and others that went into effect Jan. 653033 Schedule to increase certain subminimum wage rates for individuals with.

It brings in more than four in five dollars that fund what people usually refer to as the state budget the General Fund Lottery Funds Budget. When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes. 653030 Commissioner may prescribe lower rates in certain cases.

1 to 6 of workers wages and. 653025 Minimum wage rate. When premiums started in 2019 04 of workers wages funded the program with 63 paid by employees and 37 paid by employers.

Online Payroll Reporting System. 2018 Oregon Workers Compensation Premium Rate Ranking Summary Accessed June 5 2020. Workers Comp Insurance Coverage From AmTrust.

Oregons Self-Adjusting Tax Rate Schedules. UI Trust Fund fact sheet. Office of the Inspector General.

UI Trust Fund and Payroll Taxes FAQ. Oregon State Legislature Building Hours. Oregon Department of Consumer and Business Services.

1099G is a tax form sent to people who have received unemployment insurance benefits. Revenue from the STT goes into the Statewide Transportation. Oregon Transit Tax.

Unlike private institutions which rely more heavily on charitable donations and large endowments to help fund instruction public two- and four-year colleges rely heavily on state and local appropriations and dollars from tuition and fees. A new analysis reveals the richest 1 of Ohio households pay 50000 dollars less a year in state taxes than 17 years ago. But that rate increased on Jan.

State and local tax revenue is a major source of support for public colleges and universities. COVID-19 Interest and Penalty Relief Application. Workers Compensation Fraud Accessed June 5 2020.

This is due to the tax formula used to fund it. West Virginias House members have said they want to stabilize the trust fund but they have opposed Black Lung Association calls to increase the tax 25 from its pre-2022 levels in. AmTrust North America is one of the fastest growing insurance companies in the comp industry.

The amount of the credit shall equal a percentage of the actual excess paid to agricultural workers during the tax year as determined under section 9 of this 2022 Act. Mike DeWine we are proposing a new rate reduction for private employers BWC. Education health and human services and.

On July 1 2018 HB 2017 the Statewide Transit Tax STT went into effect which requires all employers to withhold report and remit one-tenth of one percent or 0001 of wages paid to employees. Guaranty Fund Assessment Credits. Monday - Friday 800am - 500pm 1-800-332-2313 900 Court St.

At the request of Gov. In Oregon there is no more consequential tax than the personal income tax the taxes we pay out of our earnings. Pursuant to ORS 734835 Assessments offset against tax liabilities.

5 And because they are ineligible for most federal benefits experts have long argued. 2021 Tax Rates and breakdown of changes for Oregon employers. Sation paid by an eligible employer to agricultural workers on an hourly or piece-rate basis.

If you want to fully fund your IAP you have the option to contribute your own after tax dollars to the IAP to make up for the diversion. Fund administrative costs of the states workers compensation system noncomplying employer claims a portion of Oregon OSHA administrative costs and other related programs. Basically the diversion is a correction for the monumentally stupid IAP plan created by.

653027 Wage rate for persons under 18 years of age in agriculture. More than 90 percent of the state budget goes to three key areas. The STT is calculated based on the employees wages as defined in ORS 316162.

3 Instead of committing crimes the vast majority of undocumented immigrants in the country are working 4 and paying into our tax system. Between 1990 and 2013 a period when the number of undocumented immigrants more than tripled the rate of violent crime in the US. 1 A member insurer may offset against its corporate excise tax liabilities to this state an assessment described in ORS 734815 8 at the rate of 20 percent of the amount of such assessment for each of the five calendar years following the year in which such.

The 1099G form reports the gross. 653022 Piece-rate-work-day defined for ORS 653020. Fell by 48 percent.

The Workers Benefit Fund WBF assessment This is an assessment on the payroll earned by all workers subject to Oregon workers. If approved at the Ohio Bureau of Workers Compensation BWC board meeting Feb. If approved the coronavirus stimulus checks from Oregon would help over a quarter-million Oregonians.

Even after paying approximately 18 billion in regular unemployment insurance benefits since March Oregons Trust Fund which kept Oregon solvent through the Great Recession and is on track to remain solvent through the current recession is one of the healthiest in the nation.

What Is Workers Compensation Laws And Purpose Video Lesson Transcript Study Com

Is Workers Comp Taxable Workers Comp Taxes

What Wages Are Subject To Workers Comp Hourly Inc

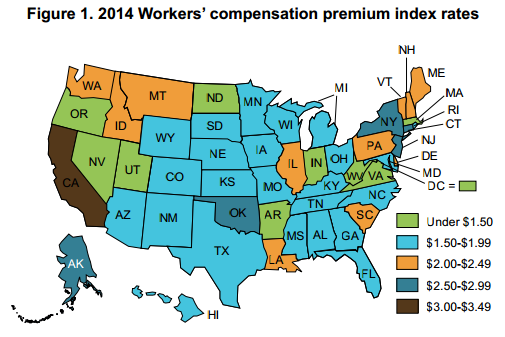

How States Rank High To Low In Workers Compensation Premiums

Two Jobs Workers Compensation Benefits Illinois Workers Compensation Lawyer

Payroll Reporting With Paypro Policyholder Center

Beware The State Of Your Workers Compensation Coverage Psa Insurance And Financial Services

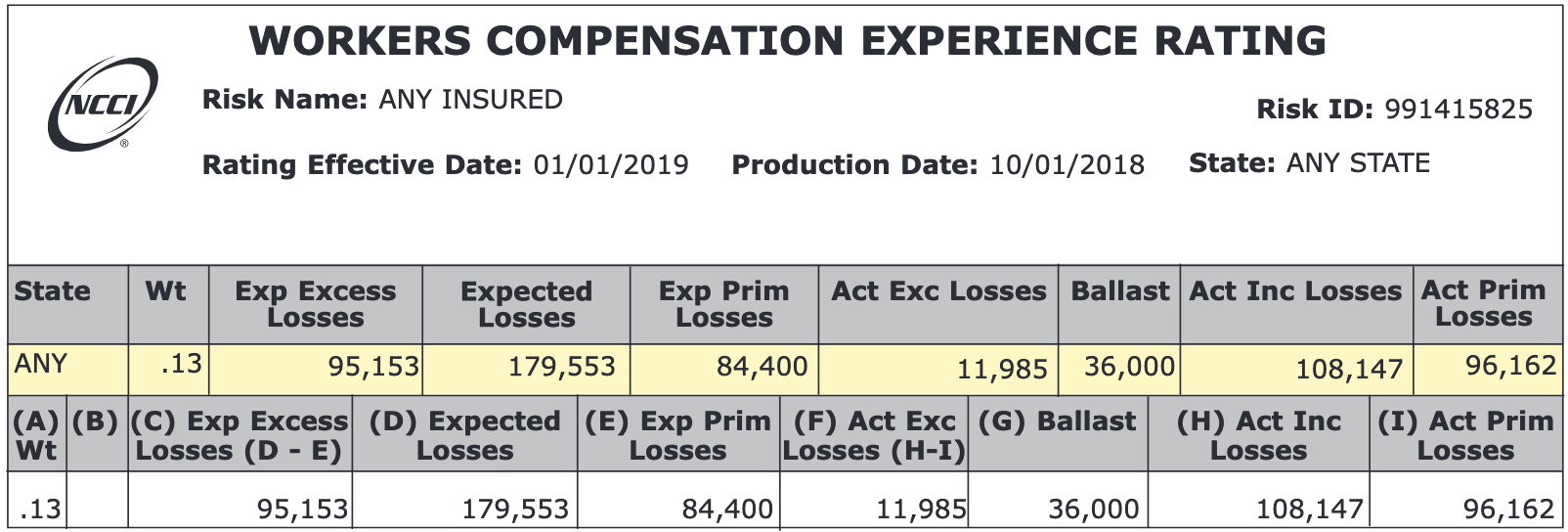

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

Workers Compensation Insurance 101 What Are Monopolistic States Sequoia

Workers Compensation Insurance Commission

Workers Compensation Overview And Description Video Lesson Transcript Study Com

What Is Workers Compensation Fraud Fighting Fraudulent Claims

Oregon Workers Benefit Fund Wbf Assessment

Quotes About Employee Compensation 38 Quotes

Employee Age And Workers Compensation Utilization Amtrust Financial